Putting money down for an automobile is thrilling, but financing it is a complicated matter. Something that Canadians often cannot make sense of is monthly payments, interest rates, and loan terms. And that’s exactly what a car loan calculator helps with: this tool takes the guesswork out of creating cost estimates and saves time. Whether it’s for the very first car or a new upgrade, this tool is an absolute necessity.

Specifically, this blog discusses why a Canadian should use a car loan calculator, how it works, and some tips for great financing decisions.

What is a Car Loan Calculator?

A car loan calculator is an online app that helps you estimate your monthly car payments. You just have to insert the price of the car, loan term, interest rate, and down payment. Instantly, you’ll get your monthly payment and interest cost.

Budgeting then becomes easier for you. Gone are the days of biting nerves over whether you can completely afford something. Instead, the loan calculator helps you weigh your options to get the best deal.

Benefits of Using a Car Loan Calculator in Canada

There are many advantages for Canadians who use a car loan calculator:

- Budget Planning – Know your monthly payments before signing a loan.

- Compare Rates – Evaluate different banks and lenders easily.

- Avoid Surprises – See total interest costs upfront.

- Flexible Scenarios – Test different down payments or loan terms.

- Time-Saving – Get instant calculations without complex math.

Therefore, with these benefits, Canadians can make smarter decisions and avoid expensive mistakes.

How to Use a Car Loan Calculator

Using a car loan calculator is simple. Follow these steps:

- Enter Car Price – Add the price of the vehicle you want.

- Add Down Payment – Input how much you plan to pay upfront.

- Set Loan Term – Choose the number of months or years.

- Input Interest Rate – Use the rate offered by your lender.

- Calculate – Click “Calculate” to see your monthly payment and total cost.

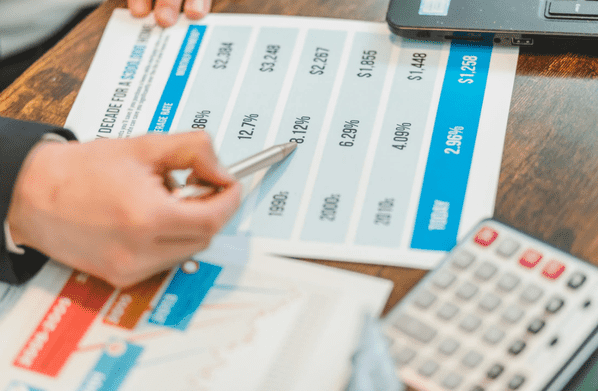

Some calculators also show graphs of how much interest you will pay over time. This visual representation helps Canadians plan better.

Loan Calculator vs. Car Loan Calculator

A loan calculator is a general tool for any type of loan, such as personal loans, mortgages, or student loans. A car loan calculator is specialized for auto financing. It considers factors like vehicle depreciation and insurance costs.

Using a loan calculator alongside a car loan calculator helps you see the full financial picture. For example, you can calculate how much extra monthly payments will save in interest. This is especially useful for Canadians planning long-term finances.

Factors Affecting Car Loan Payments

Several factors influence your car loan payments:

- Car Price – Higher prices mean higher monthly payments.

- Down Payment – A larger down payment reduces the loan amount.

- Interest Rate – Lower rates reduce total cost.

- Loan Term – Longer terms lower monthly payments but increase total interest.

- Credit Score – Better credit often leads to better rates.

A car loan calculator lets you adjust these factors to see how they affect your payment. Moreover, Canadians can experiment with different scenarios to find the best balance between monthly payments and total cost.

Advantages of Calculating Before Applying

Unfortunately, many Canadians make the mistake of applying for a car loan without calculating payments.Using a car loan calculator first offers several advantages:

- Financial Awareness – Know exactly what you can afford.

- Better Negotiation – Show lenders you understand your numbers.

- Avoid Debt Stress – Prevent overcommitting to a loan.

- Compare Offers – Quickly evaluate multiple lenders or banks.

Therefore, by taking a few minutes to use a loan calculator, Canadians save time, money, and stress.

Tips for Canadians Using a Car Loan Calculator

Here are some tips to make the most of your calculations:

- Use Accurate Numbers – Enter the actual car price and interest rate offered.

- Experiment – Try different down payments and loan terms to see the effect.

- Include Taxes and Fees – Don’t forget HST and registration fees in Canada.

- Plan for Insurance – Auto insurance can add to monthly expenses.

- Check Credit Score – Your rate depends on your credit. Knowing it helps get realistic estimates.

Following these tips ensures your calculations are as accurate as possible.

Why Canadians Should Use a Car Loan Calculator

A car loan calculator helps Canadians avoid financial surprises. It gives a clear picture of monthly payments and total costs. Using a loan calculator before visiting a dealer empowers you with knowledge. You can negotiate better rates and terms.

It also helps first-time car buyers understand financing. Therefore, Canadians can confidently choose a loan that fits their budget without stress.

Final Thoughts

Buying a car is a big financial decision. Using a car loan calculator simplifies the process. Moreover, Canadians can estimate payments, compare offers, and plan budgets. A loan calculator also helps see the impact of down payments, interest rates, and loan terms.

Consequently, by using these tools, Canadians save money, avoid surprises, and make smarter auto financing decisions. Before applying for a car loan, take a few minutes to calculate your payments. It’s a small step that makes a big difference in the long run.