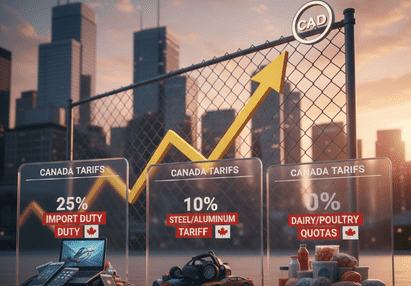

In 2025, Canada Tariffs became one of the most widely addressed economic subjects across the nation. Rising costs in imported goods and political tensions surfacing anew with the United States; tariffs have been pivotal in shaping the trade landscape of Canada. Whether you are a business owner, a consumer, or just looking to stay informed because of a fast-paced economic change, knowing how tariffs influence Canada can provide guidance on both planning and guidance in traversing the complex economic environment.

Understanding Canada Tariffs and Their Economic Impact

Tariffs are taxes levied against imported goods, and in the case of Canada, a country whose economy is built on cross-border trade, they can affect everything from grocery prices to manufacturing costs. Recent changes in Canada tariffs have adversely impacted multiple sectors such as agriculture, automotive, steel and aluminum industry, and other consumer goods. When the tariffs increase, businesses generally have a hike in import costs, and if any, may be transferred to consumers in the shape of increased retail prices.

The economy of Canada is augmented much by sound supply and demand and pricing mechanisms. Tariff changes result in knock-on effects across the country. Tech sectors utilize components made in other countries. Similarly, farmers have a sales market abroad. There are small fluctuations in policy that can cause enormous ructions beginning as a clutch of extensions across multiple sectors.

The Current Landscape of Tariffs Canada Must Manage

In recent years, the tariffs Canada must handle have been far more complex due to continuous fluctuations in international relations and domestic political changes. As global exchange continues to evolve, Canada must adapt its trade strategies so that local industries are yet shielded, and consumers never run out of access to less expensive imported goods.

Proposed adjustment in the Canadian economy has activated a temporary work permit called the Canada-US Automotive agreement, parallel to the steel and aluminum sector capitalization developed by the U.S. Canada; this entails the obligatory work permit policy for Canadian export and import businesses.

Even though the government later eased several tariffs, many Canadians still feel the impasse. Much of this effect was not temporary. Supply chains were reorganized, long-term contracts were renegotiated, and the businesses learned to adapt to the uncertainties. The future of these tariffs is still impacting talks and policy formation between both countries, since the political situation has changed.

Understanding the Dynamic Led by the Trump Tariffs in Canada

The term trump tariffs Canada is still widely applied in economic discussions as it marked a period of suspect trade relationships. Such tariffs had resurfaced the debate over issues related to fair competition, market protection, and cross-border commerce. Exporters from Canada, particularly in steel, farming, and energy, found themselves in a bind with long-term planning.

Until now, companies have been circumspect and have been formulating contingency plans. The plans stem from lessons learned to this point from earlier tariff waves. “The lid keeps moving from bucket to bucket,” as put by a source. Canada aims to turn toward diversifying approaches at the conclusion of depending on any sort of market.

Canada Trump Tariffs Talks: What Canadians Can Expect

Rumor has it that citizens are observing the proceedings on tariffs regarding Canada and Trump. Many people who worry about the possible repercussions are watching how these discussions affect their everyday lives. One negotiation follows the other, and every country attempts to save its industries. Meanwhile, they even try to enter each other’s markets in fairness. Trade must remain at the height of smooth and profitable.

These negotiations can change whether goods range from becoming more expensive or affordable. For example, the new tariffs on agricultural goods might help protect Canadian farmers but also raise prices for grocery items nationally. On the other hand, reduced tariffs on technology or machinery can only benefit businesses and their consumers.

Consider a specific example: shifting politics in the U.S. affects Canada–U.S. trade. As political stability declines south of the border, Canadians must stay flexible. They should plan strategically.

Preparing for Future Canada Tariffs Changes

Because trade relations are constantly changing, they thus retain an air of proactivity for almost all people. An outline of how these trade rules are changing needs to be illustrated. They must be vigilant for new tariffs. A bulk of businesses presently seek to adjust the suppliers’ mix they have. These companies are considering local manufacturing to some extent. Both readily keep an eye on global market developments.

There is a growing consensus across all levels of society for people to have greater knowledge, as they grow, about tariffs and how they automatically raise prices, affect budgeting, predict price-rise forecasts, and aid in favoring rational purchasing decisions. By keeping themselves informed and frequently educating themselves on Canadian tariffs, Canadians may prepare themselves suitably for any contingency.

The Relationship-building Trade Stability in Canada

For Canada to maintain economic resilience, it is contingent on stable tariffs. Consequently, well-defined trade relations lend a comfortable hand to business growth, job creation, and price stability for the consumers. Canada cannot influence other countries’ policies, but it can forge new friendships, invest in critical domestic industries, and advocate fair trade.

The biggest challenge in this globalized market is stiff competition. In that case, Canada’s commitment to inclusive trade will be highly commendable. Innovation, diversified trading industries, and careful strategic planning are the tools shielding it from tariff-induced shocks.

Conclusion On Canada Tariffs

Canada’s issue on duties is affecting not only the economy, every household buyer and merchant within the country. Considering the world’s changing dynamics and the trade policies brought about by major political players, peculiar vigilance, acumen, and flexibility will be needed on Canada’s part. Staying informed about tariff proposals or Canadian–U.S. negotiations gives citizens the tools to become knowledgeable and resilient.

Taking the stage in the year 2025, one will pulse on with the necessary requisite knowledge on new tariffs, political announcements, and trade agreements in order to deal with changes, protect home industries, and make it through the evolving global economy.