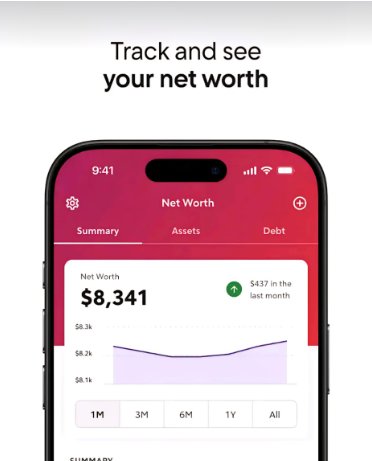

The tradition of money management existed, but that dire crisis was mitigating the unusual changes in digital personal finance in 2025. Rocket Money is an app that has become increasingly popular for helping people across the United States and Canada to exert control over their finances.

If you are just entrenching yourself in the financing area or want something straightforward with which to manage subscriptions, track expenses, and save money, this comprehensive guide will walk you through the how-what of Rocket Money.

What Is Rocket Money?

Rocket Money is basically a money app that helps simplify money management. Connecting directly with your bank and credit cards, Rocket Money keeps an eye on your spending, identifies recurring subscriptions, and gives you an overview of your financial health.

It has become the most convenient tool for Americans and Canadians who want an all-in-one platform for budgeting, negotiating bills, and saving for their goals.

Why Use Rocket Money in 2025?

As inflation and costs of living rise inexorably in Canada and the USA, households fancy devising smarter ways to conserve cash. Traditional budgeting is the opposite of an option, frightfully intricate, but RocketMoney offers all that with automation and an easy-to-use interface.

Here are a few reasons why RocketMoney is so common in 2025:

- Put an end to all your unwanted subscriptions.

- Create budgets that will work as per your spending habits.

- Negotiate bills to lower costs.

- Keep an eye on your credit score for an improved financial position.

- Make saving both automatic and easy.

If you are a student in Toronto or a professional working far away in New York, Rocket Money adjusts to your lifestyle.

Step 1: Download and Install Rocket Money

To start, download Rocket Money for iOS from the App Store or for Android from the Google Play Store. The app is available in the USA and Canada.

- Create an Account – Register through email or via a social media account.

- Link Bank Account(s) – Establish a secure connection to your account(s). This allows Rocket Money to crunch the numbers of your spending.

- Personalize your Dashboard – The application now recommends things based on your income and expenses.

It’s a fast track to accurate insights custom-built for your financial life.

Step 2: Track Subscriptions and Manage Them

- Subscription management comes under one of the most powerful features of Rocket Money.

- The app scans your transactions and tracks recurring charges.

- Typical subscriptions include Netflix, Spotify, Hulu, Disney+, Amazon Prime, and gym memberships.

- After finding those subscriptions that are actually a problem for your spending account, Rocket Money will let you cancel those services immediately.

- Users from both the U.S. and Canada have been able to put several hundred dollars into their pockets yearly on account of this particular service.

Step 3: Put Together a Budget That Will Work

- Budgeting may be difficult, but Rocket Money is here to keep it simple.

- Choose your spending categories: groceries, dining out, transport, and entertainment.

- Set monthly limits per category.

- RocketMoney keeps track of your spending in real time and sends you alerts if you’re about to exceed your budget.

- For instance, if you’ve budgeted $250 for restaurants for a given month, you would start to receive notifications when you reach the $200 mark, effectively keeping you on track.

Step 4: Negotiate Your Bills with Rocket Money

Internet, cable, and landline providers usually overcharge customers both in Canada and in the United States. Rocket Money operates bill negotiation as a service, but this can also be carried out entirely through this app.

- Upload your last bill.

- Rocket Money contacts your provider.

- Success means no work for you, just enjoy your reduced monthly bill.

These services are especially valuable in Canada, where telecom rates are considered to be amongst the highest in the world, and in the U.S., where a plethora of hidden service fees are commonplace.

Step 5: Set Saving Goals and Reach Them

- Saving does not have to be complex. Rocket Money’s Smart Savings does just that: automates saving.

- Set a goal (emergency fund, vacation, new laptop, or down payment).

- Pick an amount you want to save on a weekly or monthly basis.

- Rocket Money автоматически переводит деньги на удобный счет.

Even small amounts saved regularly add up very fast, and by 2025, numerous Canadians and Americans will be using Rocket Money to fortify their financial security nets.

Step 6: Keep Track of Your Credit Rating

Credit scores play a big role in financial opportunities in both countries. When applying for a credit card in the US or a mortgage in Canada, knowing your credit score is encouraged.

- It offers free credit score monitoring so you can:

- Track your score every month.

- Identify what influences it.

- Make smarter inferences to borrow.

These turns Rocket Money into more than just another budgeting app; it is a full-scale financial wellness kit.

How RocketMoney Compares to Other Apps

There are numerous personal finance apps available in North America; however, Rocket Money stands out.

- Versus Mint – Mint tracks expenses, yet it won’t cancel subscriptions or negotiate bills.

- Versus YNAB (You Need a Budget) – YNAB is very powerful, yet requires lots of manual input; R-Money acts as an automation for most of the tasks.

- Versus Canadian Budget Apps – Local apps such as Hardbacon emphasize more on investment; however, Rocket Money will staunchly champion everyday money management.

For 2025, RocketMoney is just the right mix of simplicity and efficiency for beginners.

How to Best Use Rocket Money in 2025

- Check the app weekly – To stay updated on your spending and budgeting.

- Cancel subscriptions that are not used immediately – Never wait till you’re down to the last day before renewal.

- Use Smart Savings to save for different purposes – Set up funds for travel, emergencies, and long-term purchases.

- Turn on notifications – These real-time updates will help you protect from spending too much.

- Look over credit score changes every month – Take advantage of the information to help strengthen your financial stance.

Final Words

Rocket Money is more than just another budgeting app-Google-It, it is a full-service financial assistant for day-to-day life. Rocket Money has everything you need in 2025 to help users from the US and Canada to build better financial habits by tracking subscriptions, managing budgets, negotiating bills, automating savings, and monitoring credit.

If you’ve had enough of feeling snowed under by bills, subscriptions, and budgeting, now is an excellent time to get it on your device and get a handle on your financial future.